On Sunday I blogged on what is happening with respect to housing in Ireland, including a breakdown of some key stats, and also did an interview on This Week on RTE Radio 1. In response, I got the following question via twitter: “So is it a bubble in Dublin then? And will govt. plans to build more houses help normalise?” These are not really questions that can be answered with 140 characters. I’ll take each question in turn.

Is a new bubble forming in Dublin?

Having fallen by 57.4% from the peak in 2007 (houses 56%, apartments 63.3%), since August 2012 prices in the capital bumped along the bottom for a few months then started to rise. Between Nov 2012 and Nov 2013 prices grew by 13.1% to be 49.2% lower than the peak. It is clear that property prices in Dublin are rising steadily at present (see CSO data and AIRO interactive graph).

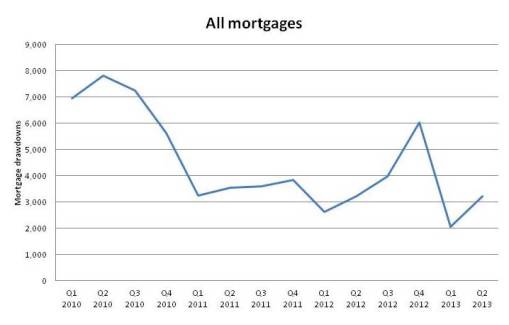

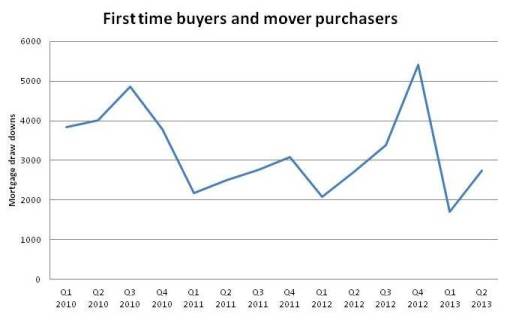

Housing bubbles generally form when there is an excess of demand, credit and confidence in prices. This is not the case in Dublin at present, with the rise in prices being principally driven by two related forces. First, both residential buyers and investors are seeking to enter the market at its bottom; this way they minimize their cost, maximize any growth in equity, and for investors gain rental yield. Second, they are competing for a small number of available properties leading to bidding scuffles. Unlike a normal bubble when there is a large number of property transactions and mortgage draw downs, transactions and draw down in Dublin are presently at 40 year historic lows. Slowing properties coming to the market are very high levels of negative equity (c. 50% of all properties with a mortgage) and low levels of new build (less than 10% the number built in 2006, and over 50% are one-offs that are not coming to the market). Ergo, prices rise as demand outstrips supply.

Does this constitute a new house price bubble? Not in the classical sense and it is only a bubble if prices rise in excess of what one might expect given the wider economy (and given they are still almost 50% less than their peak at best we’re only at the start of a potential bubble).

Will building more houses help normalise any bubble effect/slow house price rises to maintain affordability?

One proffered solution to tempering rising prices caused by a supply shortage is to increase the level of stock. New supply might come from six sources:

- new build by the private market

- new social housing provision through government investment

- defaulting properties due to mortgage arrears

- second-hand properties coming onto the market

- new areas becoming active as market activity spreads

- completion of unfinished developments

With respect to new supply by private developers and government. Whilst there is sufficient land zoned in the four Dublin local authorities (2,575 hectares/6400 acres for 132,166 units) and there are still a large number of outstanding planning permissions, the big issue is development capital and perhaps re-jigging planning permissions to cater for high density housing in some cases rather than mostly apartments. The same issue applies to the government who have little money to invest in capital expenditure programmes, which they have significantly reduced over the past few years. In both cases, even if development capital was sourced, it would be 12-24 months before new supply was available to the market/social housing waiting list. As a consequence, new supply from these sources will be limited throughout 2014.

There are significant levels of mortgage arrears nationally (we don’t have figures for Dublin alone). With respect to principal residential dwellings 141,520 (18.4%) of all mortgages are in arrears and of those 99,189 (12.9%) are more than 90 days behind in payments. The situation is worse for the buy-to-let sector where 40,426 (27.4%) are in arrears, where 31,227 (21.2%) are more than 90 days in arrears. Whilst repossessions have so far been small, it is expected that they will grow over the next couple of years. This will increase housing stock available to the market. However, their present occupants would still require accommodation having knock-on effects with respect to the social housing waiting list and the private rental market.

As house prices rise and household emerge from negative equity those wishing to trade-up or down, or to move to a new area, are more likely to place their property on the market. This would create some supply, but may not lead to prices levelling off. This is for two reasons. First, part of the reason that house prices fell so much is that the stock on the market was not representative of all stock, but rather distressed assets that owners felt compelled to sell in a falling market, with owners who could afford to avoid selling staying out of the market (typically those who are better off). Second, the majority of trading that has taken place has mainly been related to lower priced property rather than higher-end stock. We might therefore expect prices to rise a little simply as function of the nature of stock coming to the market changing, with better stock demanding higher prices and higher value properties starting to be traded more frequently. This effect would probably be little affected by more supply.

We lack detailed data concerning market activity in Dublin, but industry sources are suggesting that it is most prevalent in the city core and South Dublin. As competition for property grows in these areas it is likely that other parts of the city will become more active. The Dublin housing market stretches far beyond the M50 to the outer suburbs and commuting belt. These areas still have locales with some oversupply. Moreover, the completion of some unfinished developments would also add some new supply (though the number of such developments in and around Dublin is quite small). Both the activation of other parts of the Dublin market and the completion of unfinished developments will re-distribute some demand and work to counter supply driven price rises. Nevertheless, given the desirability of central and South Dublin and limited new supply in those areas in the very short term, one could reasonably expect rising prices to continue in the city core and South Dublin in the immediate short-term.

Two factors that might disrupt this scenario is a tailing off of demand and limited access to credit. A phenomena that occurs after some house price crashes is a dead cat bounce wherein prices rise quite quickly from the bottom, but then slow and fall again before finding an equilibrium or rising again (this happened in London following the crash at the end of the 1980s). The reason for a dead cat bounce is that those who have been waiting for the right time to enter the market (both residential buyers and investors) have done so and market demand drops leading to less competition for property, or supply has risen to meet demand. Given the level of cash sales at present (c.50%), it is possible to envisage such purchases drying up and the market returning to a more balanced status where mortgage-backed sales predominate, thus removing a significant source of competition-driven pricing. As such, a dead cat bounce could occur in the case of Dublin.

Moreover, access to credit at present is limited. In the first three quarters of 2013 only 8,711 mortgages nationwide were drawn down. Caution on behalf of lenders will limit the number of mortgages issued and the value of such mortgages, thus restricting credit-fuelled speculation and associated price rises.

With respect to the mid-to-long term it seems likely that there will be a continued rise in demand that may create supply issues in the Greater Dublin region. The new revised CSO regional population projections 2016-2031 predict: “The Greater Dublin Area will see its population increase by just over 400,000 by 2031 if internal migration patterns return to the traditional pattern last observed in the mid-1990s. … The population of Dublin is projected to increase by between 96,000 and 286,000 depending on the internal migration pattern used, while the population of the Mid-East is set to increase by between 78,000 and 144,000.” These figures are based on projected national increase and internal and external migration and seem reasonable given the dominant economic position of Dublin in the Irish economy. In addition, household fragmentation will also be a source of demand. The extent to which such population growth/household fragmentation will affect property prices is dependent on the extent to which housing supply meets demand as and when it is required.

In summary

In the short term there are potentially different scenarios as to what might happen with house prices in Dublin — they might rise steadily, rise and then level off, or suffer a dead cat bounce. Or a two-speed market might emerge in the Dublin region, with a division in market activity and pricing patterns between the city core/South Dublin and the rest of the city. Which scenario plays out is dependent on a range of factors that shape supply and demand and how they evolve. As I noted on Sunday, the market is far from normal at present and in need of a lot of correctives that could alter how the market behaves, and other factors such as the wider macro-economic context could re-cast how the market evolves. What we really need right now is some decent modelling using detailed housing, demographic and economic data of potential housing demand and supply for the Dublin region and what we might expect to happen to prices under different scenarios. We also need similar models for the rest of the country, which has a very different set of issues. Perhaps the government might commission such work?

Rob Kitchin

January 7, 2014

Is a new house price bubble forming in Dublin and could creating more supply temper price rises?

Posted by irelandafternama under #Commentaries | Tags: affordability, demand, Dublin, house prices, housing, mortgages, property bubble, supply |[2] Comments

On Sunday I blogged on what is happening with respect to housing in Ireland, including a breakdown of some key stats, and also did an interview on This Week on RTE Radio 1. In response, I got the following question via twitter: “So is it a bubble in Dublin then? And will govt. plans to build more houses help normalise?” These are not really questions that can be answered with 140 characters. I’ll take each question in turn.

Is a new bubble forming in Dublin?

Having fallen by 57.4% from the peak in 2007 (houses 56%, apartments 63.3%), since August 2012 prices in the capital bumped along the bottom for a few months then started to rise. Between Nov 2012 and Nov 2013 prices grew by 13.1% to be 49.2% lower than the peak. It is clear that property prices in Dublin are rising steadily at present (see CSO data and AIRO interactive graph).

Housing bubbles generally form when there is an excess of demand, credit and confidence in prices. This is not the case in Dublin at present, with the rise in prices being principally driven by two related forces. First, both residential buyers and investors are seeking to enter the market at its bottom; this way they minimize their cost, maximize any growth in equity, and for investors gain rental yield. Second, they are competing for a small number of available properties leading to bidding scuffles. Unlike a normal bubble when there is a large number of property transactions and mortgage draw downs, transactions and draw down in Dublin are presently at 40 year historic lows. Slowing properties coming to the market are very high levels of negative equity (c. 50% of all properties with a mortgage) and low levels of new build (less than 10% the number built in 2006, and over 50% are one-offs that are not coming to the market). Ergo, prices rise as demand outstrips supply.

Does this constitute a new house price bubble? Not in the classical sense and it is only a bubble if prices rise in excess of what one might expect given the wider economy (and given they are still almost 50% less than their peak at best we’re only at the start of a potential bubble).

Will building more houses help normalise any bubble effect/slow house price rises to maintain affordability?

One proffered solution to tempering rising prices caused by a supply shortage is to increase the level of stock. New supply might come from six sources:

With respect to new supply by private developers and government. Whilst there is sufficient land zoned in the four Dublin local authorities (2,575 hectares/6400 acres for 132,166 units) and there are still a large number of outstanding planning permissions, the big issue is development capital and perhaps re-jigging planning permissions to cater for high density housing in some cases rather than mostly apartments. The same issue applies to the government who have little money to invest in capital expenditure programmes, which they have significantly reduced over the past few years. In both cases, even if development capital was sourced, it would be 12-24 months before new supply was available to the market/social housing waiting list. As a consequence, new supply from these sources will be limited throughout 2014.

There are significant levels of mortgage arrears nationally (we don’t have figures for Dublin alone). With respect to principal residential dwellings 141,520 (18.4%) of all mortgages are in arrears and of those 99,189 (12.9%) are more than 90 days behind in payments. The situation is worse for the buy-to-let sector where 40,426 (27.4%) are in arrears, where 31,227 (21.2%) are more than 90 days in arrears. Whilst repossessions have so far been small, it is expected that they will grow over the next couple of years. This will increase housing stock available to the market. However, their present occupants would still require accommodation having knock-on effects with respect to the social housing waiting list and the private rental market.

As house prices rise and household emerge from negative equity those wishing to trade-up or down, or to move to a new area, are more likely to place their property on the market. This would create some supply, but may not lead to prices levelling off. This is for two reasons. First, part of the reason that house prices fell so much is that the stock on the market was not representative of all stock, but rather distressed assets that owners felt compelled to sell in a falling market, with owners who could afford to avoid selling staying out of the market (typically those who are better off). Second, the majority of trading that has taken place has mainly been related to lower priced property rather than higher-end stock. We might therefore expect prices to rise a little simply as function of the nature of stock coming to the market changing, with better stock demanding higher prices and higher value properties starting to be traded more frequently. This effect would probably be little affected by more supply.

We lack detailed data concerning market activity in Dublin, but industry sources are suggesting that it is most prevalent in the city core and South Dublin. As competition for property grows in these areas it is likely that other parts of the city will become more active. The Dublin housing market stretches far beyond the M50 to the outer suburbs and commuting belt. These areas still have locales with some oversupply. Moreover, the completion of some unfinished developments would also add some new supply (though the number of such developments in and around Dublin is quite small). Both the activation of other parts of the Dublin market and the completion of unfinished developments will re-distribute some demand and work to counter supply driven price rises. Nevertheless, given the desirability of central and South Dublin and limited new supply in those areas in the very short term, one could reasonably expect rising prices to continue in the city core and South Dublin in the immediate short-term.

Two factors that might disrupt this scenario is a tailing off of demand and limited access to credit. A phenomena that occurs after some house price crashes is a dead cat bounce wherein prices rise quite quickly from the bottom, but then slow and fall again before finding an equilibrium or rising again (this happened in London following the crash at the end of the 1980s). The reason for a dead cat bounce is that those who have been waiting for the right time to enter the market (both residential buyers and investors) have done so and market demand drops leading to less competition for property, or supply has risen to meet demand. Given the level of cash sales at present (c.50%), it is possible to envisage such purchases drying up and the market returning to a more balanced status where mortgage-backed sales predominate, thus removing a significant source of competition-driven pricing. As such, a dead cat bounce could occur in the case of Dublin.

Moreover, access to credit at present is limited. In the first three quarters of 2013 only 8,711 mortgages nationwide were drawn down. Caution on behalf of lenders will limit the number of mortgages issued and the value of such mortgages, thus restricting credit-fuelled speculation and associated price rises.

With respect to the mid-to-long term it seems likely that there will be a continued rise in demand that may create supply issues in the Greater Dublin region. The new revised CSO regional population projections 2016-2031 predict: “The Greater Dublin Area will see its population increase by just over 400,000 by 2031 if internal migration patterns return to the traditional pattern last observed in the mid-1990s. … The population of Dublin is projected to increase by between 96,000 and 286,000 depending on the internal migration pattern used, while the population of the Mid-East is set to increase by between 78,000 and 144,000.” These figures are based on projected national increase and internal and external migration and seem reasonable given the dominant economic position of Dublin in the Irish economy. In addition, household fragmentation will also be a source of demand. The extent to which such population growth/household fragmentation will affect property prices is dependent on the extent to which housing supply meets demand as and when it is required.

In summary

In the short term there are potentially different scenarios as to what might happen with house prices in Dublin — they might rise steadily, rise and then level off, or suffer a dead cat bounce. Or a two-speed market might emerge in the Dublin region, with a division in market activity and pricing patterns between the city core/South Dublin and the rest of the city. Which scenario plays out is dependent on a range of factors that shape supply and demand and how they evolve. As I noted on Sunday, the market is far from normal at present and in need of a lot of correctives that could alter how the market behaves, and other factors such as the wider macro-economic context could re-cast how the market evolves. What we really need right now is some decent modelling using detailed housing, demographic and economic data of potential housing demand and supply for the Dublin region and what we might expect to happen to prices under different scenarios. We also need similar models for the rest of the country, which has a very different set of issues. Perhaps the government might commission such work?

Rob Kitchin

Share this: