After Thursday’s post looking at the house price register to gauge the level of market activity in Dublin, I’ve also now had a look at the mortgage draw down data produced by the Irish Banking Federation and PwC. Their database runs from Q1 2005 to Q2 2013 and claims to include 95% of the Irish residential mortgage transactions; the data is not geographically disaggregated.

Thursday’s post revealed that the number of sales in Dublin had been steady year-on-year across quarters, with the exception of Q4 2012 when there was a spike in sales due to the ending of mortgage interest relief. In other words, there has been little noticable difference in the volume of housing sales during 2013 compared with 2010.

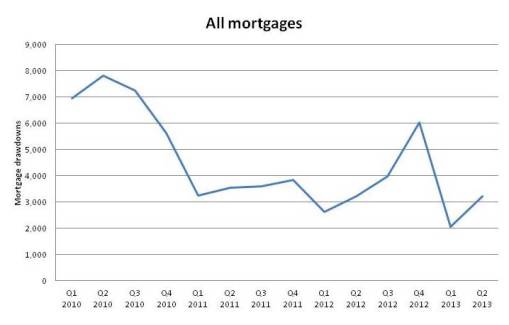

The IBF PwC data reveals a similar pattern of purchasing, including the Q4 2012 spike. If we compare Q2 volumes from 2010-2013, the volumes are Q2 2010 – 7,827; 2011 – 3,551; 2012 – 3,225; 2013 – 3,229. In other words, there was a large drop from Q2 2010 to Q2 2011, and then the same volumes for the next three years. For reference, draw downs in Q2 2013 were only 5.9% of those in Q2 2006 (53,499).

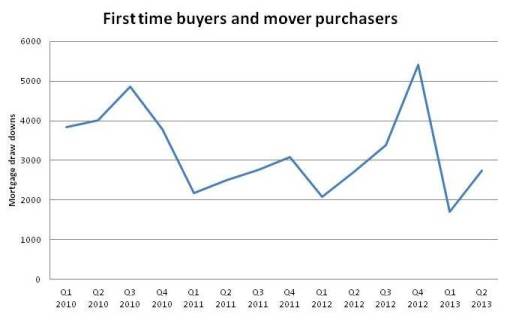

This pattern is consistent when we remove buy to let, re-mortgaging and top-up mortgages (though these were more prevalent in 2010) so that we only examine first-time buyer and purchaser mover figures.

As with the house price register data, the mortgage draw down data does not suggest that there is a pick up in the housing market to any great degree. There was a brief surge in Q4 2012 due to MIR ending, but the market has since reverted to the same state of play as 2011 and 2012.

So that’s two pieces of hard evidence – one generated from Revenue data (inc cash sales) and one by the banking industry – that cast doubt on property sector rhetoric that there has been an upswing in the housing sales. That’s not to say that there has not been an increase in market activity in terms of viewings and multiple bids on some properties, but that this is restricted to a select group of properties and is not translating into an overall increase in sales.

Rob Kitchin

August 17, 2013 at 10:27 pm

I know a number of young couples who are negative equity trapped in Tigerland apartments and who now have young families.

All of them are letting their apartments and renting three bedroom houses themselves,and plan to do so for the foreseeable future.

(They have little choice in the matter)

Some of them are renting the houses from friends who have lost their jobs and are now working abroad.!

A happy arrangement for everybody.

Expect more of the same..