The Spanish property soap opera

Posted by irelandafternama under

#Commentaries,

News stories | Tags:

Ireland,

property,

Spain,

unsold units |

Leave a Comment

The print version of the property section in The Guardian carried a piece by Grahan Norword on the property bust in Spain (I can’t find an online version, so apologies for no link). The headline was: ‘Building bust after the boom casts a shadow over property in the sun.’ The tagline: ‘Unhappy buyers, corrupt councillors, illegal homes – all part of the storline in a new Spanish soap opera.’ It provides some interesting figures regarding the Spanish property sector, and the story being told is not wildly dissimilar to Ireland – falling prices, negative equity, a glut of unsold new property – though there are some differences, particularly with respect to some developments being deemed illegal and being knocked, and politicians being jailed for taking bungs from developers.

The piece reports that there are approximately 600,000 new unsold homes (Ireland c. 23,000) and 200,000 part-complete unsold homes (Ireland c. 20,000). If you scale the Irish population (4.5m) to Spain (46m), then it’s clear the unsold, brand new property overhang is significantly worse in Spain (by a factor of 3); the part-complete units though are broadly comparable. The article does not discuss the phenomenon of unfinished estates, but one presumes that a large number of households are living on either under-construction estates and/or estates with high vacancy. The official house price fall is 17% (Ireland is c. 40% – see here for latest roundup of estimates), though estate agents are reporting 20-50% depending on area. Holiday homes are down c. 40%. There has been a 43% collapse in the value of Spanish construction industry and drop in land values of c. 50% (Ireland c. 70-95% depending on location). On top of the unsold units, Spanish banks are apparently sat on a glut of repossessed homes, which they are obliged to release to the market after two years (meaning they will start to flood onto the market from later on this year). In addition, the issue of illegal build rumbles on. For example, 12,697 homes were recently declared illegal in the Almanzora Valley in south-east Spain, 920 of which are earmarked for demolition, leaving owners in a precarious position.

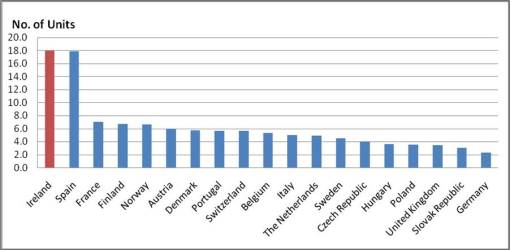

What the article makes clear is that both Ireland and Spain share some broadly similar issues with regards our respective housing markets, which perhaps isn’t a surprise when you look at the rate both countries were building properties at the peak of the boom.

Housing unit completions per 1000 population for Europe in 2007

Rob Kitchin

April 5, 2011

The Spanish property soap opera

Posted by irelandafternama under #Commentaries, News stories | Tags: Ireland, property, Spain, unsold units |Leave a Comment

The print version of the property section in The Guardian carried a piece by Grahan Norword on the property bust in Spain (I can’t find an online version, so apologies for no link). The headline was: ‘Building bust after the boom casts a shadow over property in the sun.’ The tagline: ‘Unhappy buyers, corrupt councillors, illegal homes – all part of the storline in a new Spanish soap opera.’ It provides some interesting figures regarding the Spanish property sector, and the story being told is not wildly dissimilar to Ireland – falling prices, negative equity, a glut of unsold new property – though there are some differences, particularly with respect to some developments being deemed illegal and being knocked, and politicians being jailed for taking bungs from developers.

The piece reports that there are approximately 600,000 new unsold homes (Ireland c. 23,000) and 200,000 part-complete unsold homes (Ireland c. 20,000). If you scale the Irish population (4.5m) to Spain (46m), then it’s clear the unsold, brand new property overhang is significantly worse in Spain (by a factor of 3); the part-complete units though are broadly comparable. The article does not discuss the phenomenon of unfinished estates, but one presumes that a large number of households are living on either under-construction estates and/or estates with high vacancy. The official house price fall is 17% (Ireland is c. 40% – see here for latest roundup of estimates), though estate agents are reporting 20-50% depending on area. Holiday homes are down c. 40%. There has been a 43% collapse in the value of Spanish construction industry and drop in land values of c. 50% (Ireland c. 70-95% depending on location). On top of the unsold units, Spanish banks are apparently sat on a glut of repossessed homes, which they are obliged to release to the market after two years (meaning they will start to flood onto the market from later on this year). In addition, the issue of illegal build rumbles on. For example, 12,697 homes were recently declared illegal in the Almanzora Valley in south-east Spain, 920 of which are earmarked for demolition, leaving owners in a precarious position.

What the article makes clear is that both Ireland and Spain share some broadly similar issues with regards our respective housing markets, which perhaps isn’t a surprise when you look at the rate both countries were building properties at the peak of the boom.

Housing unit completions per 1000 population for Europe in 2007

Rob Kitchin

Share this:

Related